- Gujarat

- Free rides on AMTS buses for three days during Diwali

- 100 years of service to nation was our duty, so no celebration is needed: RSS Chief

- Commonwealth Sport Board Recommends Ahmedabad as Host City for 2030 Commonwealth Games

- Gujarat CM to visit Mumbai for listing of SMC’s green municipal bonds on NSE

- We Complain About Traffic While Sitting in Cars: Housing Secretary’s Bold Call for Citizen Action

- 3.2 crore-plus to get free grains, subsidized oil & sugar from 17,000 fair price shops in Gujarat: Govt

- AMC Fire dept issues public advisory about firecrackers ahead of Diwali

- Gujarat@75: Agenda for 2035 unveiled; AI-based education, ₹7.5 lakh crore infra part of development plan

- Gujarat Govt issues circular regarding use of Ration Card

- Plot Sale Goof-up: AUDA Sells Land Meant for Service Road

- All Stories

Articles tagged under: GST

Gujarat SGST dept conducts searches at firecracker traders ahead of Diwali

October 11, 2025Ahemdabad: With Diwali just days away, the Gujarat State GST (SGST) department launched a major crackdown on firecracker traders across the state on Friday, targeting overpricing and tax evasion. SGST teams have begun inspections at over 50 businesses, with intensive checks in Ahmedabad and Surat. Officers are examining billing records, accounts, and stock registers to ensure traders sell goods at or below MRP and comply with tax regulations. In Surat and Navsari, officials searched the premis...Read More

Gujarat SGST dept busts ₹560-crore bogus billing racket masterminded by Jamnagar-based CA

October 09, 2025Jamnagar: The State Goods and Services Tax (SGST) Department, Gujarat has uncovered a massive tax evasion racket exceeding ₹100 crore, masterminded by Jamnagar-based Chartered Accountant Alkesh Pedhadiya through an elaborate bogus billing network, an official statement said today. Acting on specific intelligence and following sustained surveillance, the Department conducted simultaneous search operations on October 3, 2025, at 25 premises, including the office of Brahm Associates, a CA firm i...Read More

Fitness club in Surat collects fees in weekly installments to avoid full GST; gets recovery notice

October 08, 2025Surat: The State Goods & Services Tax (SGST) department has launched an investigation into a fitness and entertainment club in the upscale Vesu area of the city for allegedly not paying the full 18% GST on membership fees. Following a preliminary inquiry, the department issued a recovery demand notice of ₹35 lakh to the club operators. Officials from the SGST department visited the under-construction club, developed by a well-known builder group, and conducted an on-site investigation tod...Read More

Gujarat State GST Dept Crackdown on Food Outlets, Restaurants; ₹4.88 Crore Tax Evasion Unearthed

September 27, 2025Ahmedabad: The Gujarat State Tax Department (SGST) has busted cases of tax evasion in the Food/Restaurant sector under the GST Composition Scheme. Based on specific complaints and intelligence inputs, the state tax officials first visited several premises discreetly as customers to assess actual business activity and billing processes. Thereafter, the SGST department conducted coordinated search operations on 21st and 22nd September 2025 across 25 premises linked to 16 taxpayers operating in Ahm...Read More

Amul passes on Full GST 2.0 Reduction Benefit to Customers; 700+ products to get cheaper

September 20, 2025Anand: The dairy sector giant Amul today announced its revised price list of 700+ products, offering the full benefit of GST reduction to its customers, effective 22nd September 2025, the date the revised GST rates come into effect. This revision spans a range of product categories, including Butter, Ghee, UHT milk, Ice-cream, Cheese, Paneer, Chocolates, Bakery items, Frozen dairy and potato snacks, Condensed milk, Peanut spread, Malt-based drinks, etc. Amul also thanked Prime Minister Narendr...Read More

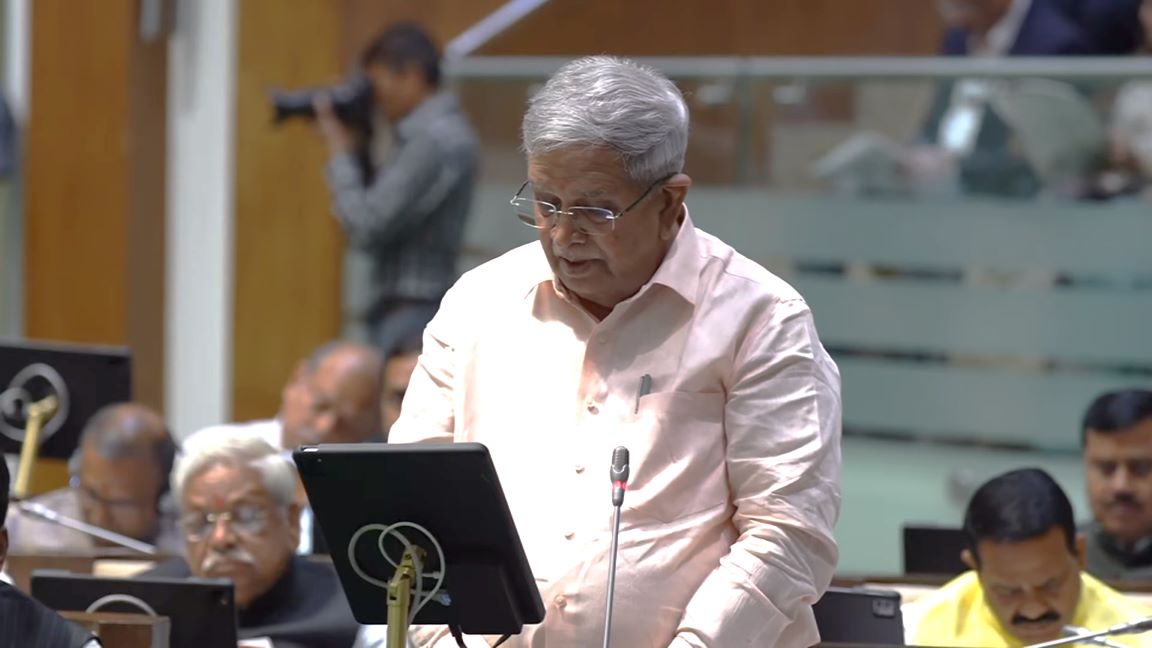

GST Overhaul Simplifies Tax System, Boosts Growth and Employment: BJP Spokesperson

September 16, 2025Gamdhimaha: “GST reforms are the largest economic reform in the country,” said the National Spokesperson of the ruling Bharatiya Janata Party, Dr. Guruprakash Paswan, while addressing a press conference held today at the State BJP headquarters, Shri Kamalm. The press conference was held to discuss the latest changes in GST slabs, which will come into effect from 22nd September 2025. Addressing the press, Dr. Paswan stated that the government of Prime Minister Narendra Modi has fulfilled all...Read More

Gujarat to have three GST Tribunal within 2025

September 16, 2025Gandhinagar: Gujarat may get three GST Tribunals by 2025 year-end. While locations of two tribunals are already decided, and they are Ahmedabad and Surat, the third location is still undecided, and it may most probably come up in Saurashtra region. The Centre has approved three GSt Tribunals in Gujarat in response to long-pending demand by traders. DeshGujaratRead More

GST Reforms to Improve Living Standards, Strengthen Social Security: Gujarat FM

September 04, 2025Gandhinagar: Chief Minister Bhupendra Patel expressed his heartfelt gratitude to Prime Minister Narendra Modi and Union Finance Minister Nirmala Sitharaman for reducing GST rates on various goods and services used in daily life. Finance Minister Kanubhai Desai said that in the 56th GST Council meeting, various structural reforms, revisions in tax rates, and measures for ease of living were recommended in the interest of farmers, common citizens, and small and medium entrepreneurs. With these rev...Read More

Next Generation GST Reform Announced; To Be Effective from 1st Day of Navratri

September 03, 2025New Delhi: The 56th meeting of the GST Council was held in New Delhi under the chairpersonship of the Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman. The GST Council inter-alia made the recommendations relating to changes in GST tax rates, provide relief to individuals, common man, aspirational middle class and measures for facilitation of trade in GST. FAQs are also being issued for clarification of doubts. The recommendations made by the 56th GST Council are as be...Read More

GST revenue of Gujarat up 6% in August 2025 compared to August 2024

September 01, 2025New Delhi: In August 2025, Gujarat’s Goods and Services Tax (GST) revenue rose by 6% compared to the same month last year. Data shared by the central government shows that the state’s GST collection increased from ₹10,344 crore in August 2024 to ₹10,992 crore in August 2025. At the national level, GST revenue grew by 10%, rising from ₹1,13,586 crore in August 2024 to ₹1,24,986 crore in August 2025. Although the figures released by the central government are provisional and subject t...Read More