GST Reforms to Improve Living Standards, Strengthen Social Security: Gujarat FM

September 04, 2025

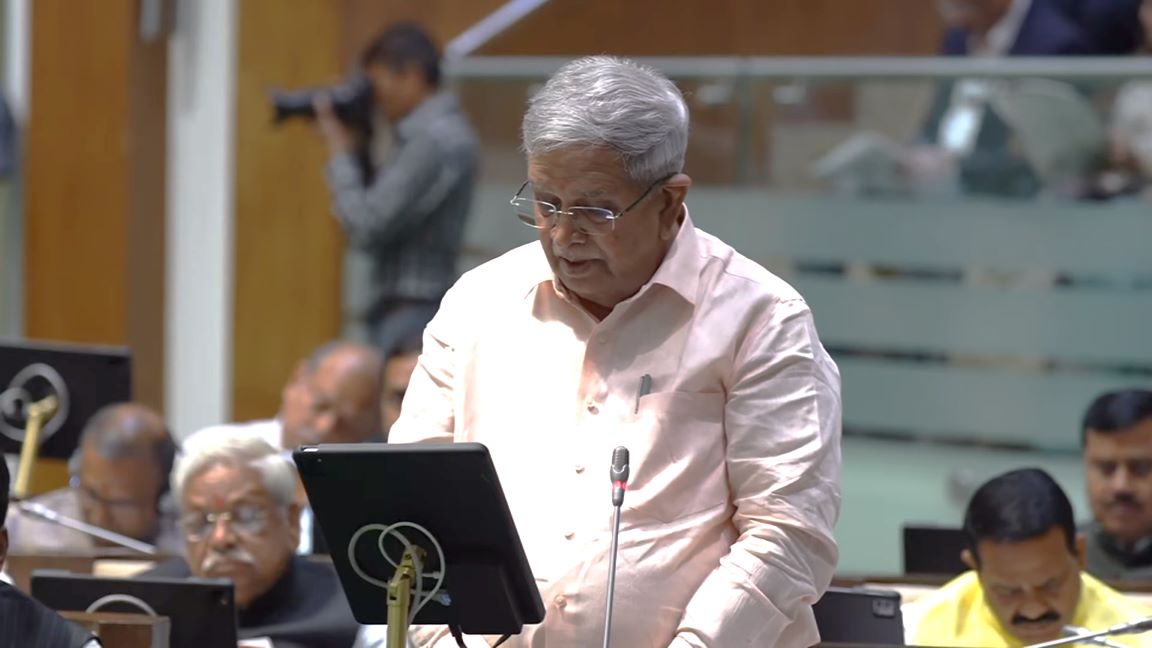

Gandhinagar: Chief Minister Bhupendra Patel expressed his heartfelt gratitude to Prime Minister Narendra Modi and Union Finance Minister Nirmala Sitharaman for reducing GST rates on various goods and services used in daily life. Finance Minister Kanubhai Desai said that in the 56th GST Council meeting, various structural reforms, revisions in tax rates, and measures for ease of living were recommended in the interest of farmers, common citizens, and small and medium entrepreneurs. With these revisions, Gujarat’s economy will become stronger.

Giving details about these landmark recommendations, the Finance Minister said that until now, the tax rate on tractors, fertilizers, irrigation equipment, and other agricultural machinery ranged between 12 to 18 percent. This has now been reduced to only 5 percent, which will significantly reduce agricultural production costs. This major step will benefit crores of farmers in Gujarat.

Further, the Minister said that apart from farmers, the tax rate has also been reduced on various items needed by common citizens in their daily lives. He shared the details as follows:

-

Tax exemption has been given on food items like paratha, khakra, paneer, and pizza bread.

-

The tax rate on items like pastries, cakes, chocolate, candy, and cereal flakes has been reduced from 18 percent to 5 percent.

-

The tax rate on diabetic food, soya milk, milk-based drinks, and fruit pulp drinks has been reduced from 18 percent to 5 percent.

-

The tax rate on daily-use items like toothpaste, shaving cream, and soap has been reduced to 5 percent.

-

The tax rate on essential electrical appliances like televisions, air conditioners, refrigerators, and washing machines has been reduced from 28 percent to 18 percent.

-

Individual mediclaim and individual life insurance premiums have been exempted from GST.

-

Medicines used for treating life-threatening diseases like cancer have also been exempted from tax.

-

The tax rate on items such as surgical instruments, medical-grade oxygen, and glucometers has been reduced from 12 percent to 5 percent.

-

Stationery items like erasers, sharpeners, books, and maps have been exempted from GST. Additionally, the tax rate on paper, mathematical instrument boxes, geometry boxes, and color boxes has been reduced to 5 percent.

-

The tax rate on handicraft items such as idols, lamps, paintings, and stonework has been reduced from 12 percent to 5 percent.

-

The Minister also said that the tax rate on petrol, LPG, and CNG variant vehicles with engine capacity below 1,200 CC, and diesel vehicles with engine capacity below 1,500 CC, has been reduced from 28 percent to 18 percent. This will directly benefit small and middle-class families. The revision of tax rates will improve the living standards of common citizens and enhance social security.

Talking about the renewable energy sector, the Minister said that to promote the use and production of renewable energy, the tax rate on solar, wind, and wave energy equipment and their parts has also been reduced from 12 percent to 5 percent. Micro and small industries will benefit from this amendment.

“The reduction in tax rates will boost the consumption of goods. Improved classification of goods and services will help reduce litigation while also promoting the ‘Ease of Doing Business.’ Reforms to simplify the registration process will improve business cash flow and reduce compliance costs. Additionally, financial liquidity concerns will be addressed by simplifying and expediting the refund process,” Desai added.

Thus, with these landmark recommendations made by the GST Council, keeping in mind the interests of all sections of society, the economies of India and Gujarat will advance more rapidly, realizing the vision of “Gatiman Gujarat, Gatiman Bharat” and “Vikasit Bharat – 2047,” he further said. DeshGujarat

Recent Stories

- India vs SL Match

- Free rides on AMTS buses for three days during Diwali

- 100 years of service to nation was our duty, so no celebration is needed: RSS Chief

- Commonwealth Sport Board Recommends Ahmedabad as Host City for 2030 Commonwealth Games

- Gujarat CM to visit Mumbai for listing of SMC's green municipal bonds on NSE